More Than Half (55%) Of All Americans Making Monthly Payments On Car Leases Or Loans Say These Loans Are Burdensome Enough To Prevent Them Making Major Purchases, Such As For Homes, Appliances Or Furniture, According To The Cambridge Consumer Credit Index. Of All Americans Surveyed, 46% Have Outstanding Car Loans Or Leases And 54% Make No Car Payments.

Of those making car payments, 32% spend less than $300 a month, 50% pay between $300 and $500, 10% pay between $500 and $700 and 7% pay more than $700 a month.

The Cambridge Index also asked if people intend to buy or lease a car or truck in the next six months, and found that 17% of the respondents are somewhat or very likely to purchase a car over that time, with 6% very likely to buy and 11% somewhat likely to purchase.

"It's surprising that there is still such a great pent-up demand for cars and trucks among American consumers, considering that auto sales have been extremely strong this year because of heavy promotions from the carmakers. Even though more than half of Americans find their car loans or leases burdensome, they still seem to be willing to take on even more debt to acquire the latest models," said Jordan Goodman, spokesperson/financial analyst for the Cambridge Consumer Credit Index.

These findings are the result of monthly nationwide telephone poll of 1000+ adults conducted by ICR/International Communications Research in the past week, sponsored by the Debt Relief Clearinghouse.

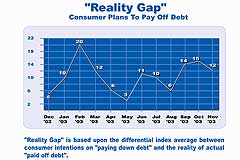

The overall Cambridge Consumer Credit Index is up by two points in November to 60. The Index was down slightly in the "last month" question, up sharply in the "next month" question and unchanged in the "next six month" question. The "Reality Gap," which is the difference between the amount of debt consumers say they will pay off in the next month versus the amount of debt they actually paid off a month later, narrowed by 3 percentage points to 12 points from 15 points in October. A month ago, 81% of Americans planned to pay off debt, while a month later 69% actually did so.

The Cambridge Consumer Credit Index is a forward looking economic indicator gauging consumer spending and debt. It is released on the fifth business day of every month to coincide with the Federal Reserve Board's G19 release of consumer credit outstanding data.

In conjunction with the Index, the Cambridge Credit Counseling Corp. is releasing its monthly survey of people who have called in for credit counseling services over the past month. Cambridge representatives ask callers for the primary reason that they found it necessary to get help with their debts now. Of the 845 people who answered, this was the order of their responses:

- I am frustrated with high bank rates and fees (32.1%)

- My income has been reduced from a lower salary, less overtime or layoff (23.6%)

- I want to improve my ability to achieve future financial goals like buying a house or saving for retirement (12%)

- I got into too much debt by overspending (10.5%)

- My lack of financial education caused me to take on too much debt (7.3%)

- Other reasons (7.3%)

- Large medical expenses forced me to take on huge debts (4.6%)

- My recent divorce or widowhood forced me to take on large debts (2.6%)

For more information on the survey see http://www.cambridgeconsumerindex.com/camsurvey.htm

The Cambridge Consumer Credit Index number is a composite of these three questions:

- In the past month, have you taken on more debt or paid off debt? The Index reads 64 on this question, a drop of two points from October. In November, 32% of Americans say they have taken on more debt, with 24% taking on a little and 8% taking on a lot more debt. Conversely, 69% of Americans have paid off debt, with 52% paying off a little and 17% paying off a lot.

- In the next month, do you anticipate taking on more debt or paying off debt? The Index reads 46 on this question, an increase of eight points from October. In November, 23% plan to take on more debt, with 3% planning to take on a lot and 20% planning to take on a little debt. Conversely, 77% plan to pay off debt, with 65% paying off a little and 12% paying off a lot. In October 19% planned to take on debt and 81% planned to pay off debt.

- In the next six months, do you expect to take on debt because you are thinking of making a major purchase such as a car, education, appliance, medical procedure, furniture or carpeting? The Index reads 70 on this question, unchanged from October.

In November, 35% of Americans plan to take on more debt to make such purchases, with 7% taking on a lot of debt and 28% taking on a little more debt. In contrast, 65% of Americans plan to pay off debt in the next six months, with 51% expecting to pay off a little and 14% expecting to pay off a lot. In October, 34% of Americans planned to take on more debt, while 65% planned to pay off debt.

"The Cambridge Consumer Index shows that consumers are increasingly optimistic about the coming holiday season since their intentions to add debt over the next month rose significantly. While some of this increase is seasonal and is to be expected, clearly consumers are feeling better about the state of the economy and are therefore more willing to take on debt to buy holiday gifts," says Jordan Goodman, spokesperson for the Index.

The Index survey is conducted by ICR (International Communications Research) of Media, Pennsylvania over five days in the week before the Index is released. Over 1000 households are polled based on random-digit dialing, with all demographic and regional groups in America fairly represented. The Index has a margin of error of plus or minus three percentage points.