AAA is a federation of motor clubs serving more than 49 million members in the United States and Canada through more than 1,100 offices.

Founded in 1902, AAA is a not-for-profit, fully taxpaying corporation. Its purpose is two-fold: give members a full range of automotive and travel-related services and promote the interests of motorists and travelers through legislative and educational activities.

AAA has published Your Driving Costs since 1950. That year, driving a car 10,000 miles annually cost 9 cents a mile, and gasoline sold for 27 cents per gallon.

Because it incorporates significant changes to driving cost calculations — most notably the averaging of costs for multiple top-selling vehicles in each size/type category — this edition of Your Driving Costs is not comparable to previous editions. The changes in methodology are designed to provide more accurate driving costs and better reflect current consumer vehicle purchasing habits.

Methodology The process used to estimate annual driving costs for this brochure is proprietary to AAA. It incorporates standardized criteria designed to model the average AAA member's use of a vehicle for personal transportation over five years and 75,000 miles of ownership.

The use of standardized criteria ensures AAA's estimates are consistent when comparing driving costs of different vehicle makes and models. Actual driving costs will vary based on individual driving habits, location, operating conditions and other factors.

Estimates are provided to help consumers make informed vehicle purchase decisions and budget for annual automotive expenses.

Following are AAA average per-mile costs and the composite average cost for three size categories of sedans:

AAA Average Costs Per Mile

| Miles per Year | 10,000 | 15,000 | 20,000 |

| Small Sedan | 50.5 cents | 41.7 cents | 37.6 cents |

| Medium Sedan | 62.4 cents | 53.1 cents | 48.8 cents |

| Large Sedan | 72.9 cents | 61.9 cents | 56.5 cents |

| Composite Average | 62.0 cents | 52.2 cents | 47.7 cents |

Detailed driving costs for small, medium and large sedans are provided on pages 6 and 7. Driving costs for four-wheel-drive sport utility vehicles and minivans are listed on page 8. Though not part of the composite AAA average, SUV and minivan information is included to help buyers estimate operating costs for these types of vehicles.

Driving costs in each category are based on average costs for five top-selling models selected by AAA. By size category, they are:

- Small sedan — Chevrolet Cobalt, Ford Focus, Honda Civic, Nissan Sentra and Toyota Corolla.

- Medium sedan — Chevrolet Impala, Ford Fusion, Honda Accord, Nissan Altima and Toyota Camry.

- Large sedan — Buick Lucerne, Chrysler 300, Ford Five Hundred, Nissan Maxima and Toyota Avalon.

Selected SUV models include Chevrolet TrailBlazer, Ford Explorer, Jeep Grand Cherokee, Nissan Pathfinder and Toyota 4Runner. Minivans include Chevrolet Uplander, Dodge Grand Caravan, Ford Freestar, Honda Odyssey and Toyota Sienna.

AAA's analysis covers vehicles equipped with standard and optional equipment including automatic transmission, air conditioning, power steering, antilock brakes and cruise control, to name a few.

Fuel Fuel costs were based on $2.405 per gallon, the late-2005 U.S. price from AAA's Fuel Gauge Report: www.fuelgaugereport.com. Fuel mileage is based on Environmental Protection Agency fuel-economy ratings weighted 60 percent city and 40 percent highway driving.

Maintenance Costs include retail parts and labor for normal, routine maintenance as specified by the vehicle manufacturer. They also include the price of a comprehensive extended warranty with one warranty claim deductible of $100 and other wear-and-tear items that can be expected to require service during five years of operating the vehicle. Sales tax is included on a national average basis.

Tires Costs are based on the price of one set of replacement tires of the same quality, size and ratings as those that came with the vehicle. Mounting, balancing and sales tax also are included.

Insurance AAA based its insurance costs on a full-coverage policy for a married 47-year-old male with a good driving record, living in a small city and commuting three to 10 miles daily to work. The policy includes $100,000/$300,000 coverage with a $500 deductible for collision and a $100 deductible for comprehensive coverage.

License, Registration and Taxes Costs include all governmental taxes and fees payable at time of purchase, as well as fees due each year to keep the vehicle licensed and registered. Costs are computed on a national average basis.

Depreciation Depreciation is based on the difference between new-vehicle purchase price and estimated trade-in value at the end of five years.

Finance Costs are based on a five-year loan at 6 percent interest with a 10 percent down payment. The loan amount includes taxes and the first year's license fees, both computed on a national average basis.

To figure your fuel cost, begin with a full tank of fuel and write down the odometer reading. Each time you fill up, note the number of gallons, how much you pay and the odometer reading. These figures can then be used to calculate average miles per gallon and cost of fuel per mile.

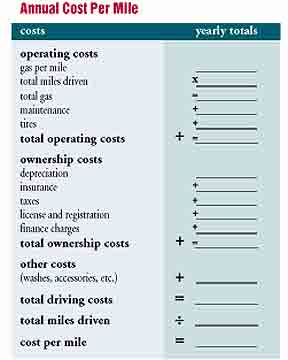

To determine your driving costs accurately, keep personal records on all the costs listed below. Use this worksheet to figure your total cost to drive:

| Driving Costs | Small Sedan† | Medium Sedan† | Large Sedan† | Average | 4WD Sport Utility Vehicle† | Minivan† |

| Operating Costs | per mile | per mile | per mile | per mile | per mile | per mile |

| Gas | 8.0 cents | 9.8 cents | 10.7 cents | 9.5 cents | 13.7 cents | 11.4 cents |

| Maintenance | 4.5 cents | 4.9 cents | 5.4 cents | 4.9 cents | 5.6 cents | 5.0 cents |

| Tires | 0.5 cents | 0.8 cents | 0.7 cents | 0.7 cents | 0.8 cents | 0.6 cents |

| Cost per Mile | 13.0 cents | 15.5 cents | 16.8 cents | 15.1 cents | 20.1 cents | 17.0 cents |

| Ownership Costs | per year | per year | per year | per year | per year | per year |

| Full-Coverage Insurance | $892 | $902 | $982 | $926 | $918 | $843 |

| License, Registration, Taxes | $397 | $551 | $658 | $535 | $683 | $612 |

| Depreciation (15,000 miles annually) | $2,503 | $3,449 | $4,224 | $3,392 | $4,254 | $4,043 |

| Finance Charge(10% down; loan @ 6%/5 yrs.) | $511 | $739 | $899 | $716 | $935 | $830 |

| Cost per Year | $4,303 | $5,642 | $6,763 | $5,569 | $6,790 | $6,328 |

| Cost per Day | $11.79 | $15.46 | $18.53 | $15.26 | $18.60 | $17.34 |

| Total Cost Per Mile | ||||||

| 10,000 Total Miles per Year | per year | per year | per year | per year | per year | per year |

| Cost per Mile x 10,000 | miles $1,300 | $1,550 | $1,680 | $1,510 | $2,010 | $1,700 |

| Cost per Day x 365 Days | $4,303 | $5,642 | $6,763 | $5,569 | $6,790 | $6,328 |

| Decreased Depreciation*** | -$550 | -$950 | -$1,150 | -$883 | -$900 | -$900 |

| Total Cost per Year | $5,053 | $6,242 | $7,293 | $6,196 | $7,900 | $7,128 |

| Total Cost per Mile* | 50.5 cents | 62.4 cents | 72.9 cents | 62.0 cents | 79.0 cents | 71.3 cents |

| 15,000 Total Miles per Year | per year | per year | per year | per year | per year | per year |

| Cost per Mile x 15,000 Miles | $1,950 | $2,325 | $2,520 | $2,265 | $3,015 | $2,550 |

| Cost per Day x 365 Days | $4,303 | $5,642 | $6,763 | $5,569 | $6,790 | $6,328 |

| Total Cost per Year | $6,253 | $7,967 | $9,283 | $7,834 total | $9,805 | $8,878 |

| Total Cost per Mile* | 41.7 cents | 53.1 cents | 61.9 cents | 52.2 cents | 65.4 cents | 59.2 cents |

| 20,000 Total Miles per Year | per year | per year | per year | per year | per year | per year |

| Cost per Mile x 20,000 Miles | $2,600 | $3,100 | $3,360 | $3,020 | $4,020 | $3,400 |

| Cost per Day x 365 Days | $4,303 | $5,642 | $6,763 | $5,569 | $6,790 | $6,328 |

| Increased Depreciation** | $625 | $1,025 | $1,175 | $942 | $975 | $975 |

| Total Cost per Year | $7,528 | $9,767 | $11,298 | $9,531 | $11,785 | $10,703 |

| Total Cost per Mile* | 37.6 cents | 48.8 cents | 56.5 cents | 47.7 cents | 58.9 cents | 53.5 cents |

* total cost per year ÷ total miles per year

** increased depreciation for mileage over 15,000 miles annually

*** decreased depreciation for mileage under 15,000 miles annually

† see page 2 for a listing of vehicle makes and models used for driving cost calculations

AAA's suggested budget for a family of four — two adults and two children — is at least $261 per day for lodging and meals, plus $15.10 per 100 miles for gas, tires and maintenance with the car averaging 25.8 miles per gallon.

Lodging

The average cost for lodging is $141 per night, based on the most recent rates charged by approved accommodations listed in AAA TourBook® guides. This rate includes an extraperson charge for children. However, if children are within an age limit set by management — usually up to 14 — there may not be an extra charge. Vacation spending depends on a family's preferences and means, but costs also vary by area. Expect higher lodging rates in large metropolitan areas and at resorts in season.To save on lodging, it's best to make advance reservations. If that's not possible, plan to arrive early for a wider selection of accommodations. Meals For a family of four, AAA suggests budgeting at least $120 a day for meals, not including tips or beverages.

Meal

Meal costs can be reduced by eating the main meal at midday to take advantage of lower lunch prices at restaurants. Many restaurants offer children's menus and 'early bird' dinner specials at reduced prices.Additional Costs

In addition to lodging, food and driving costs, you should budget for admission fees, road and bridge tolls, recreation and shopping. If you don't carry credit cards, include an emergency fund in your vacation budget. For added security, AAA suggests carrying travel money such as prepaid money cards or travelers cheques. The AAA Visa TravelMoney card is a prepaid credit card that also offers 24-hour ATM access to cash in more than 120 local currencies. AAA members also can obtain fee-free travelers cheques from their local AAA office.Business Travel

Although some firms continue to provide vehicles to full-time business travelers, a growing number of employees use their own vehicles for company business.

Companies use three primary methods to reimburse employees for business use of personal vehicles.

Getting Reimbursed

Flat mileage allowance.

Many companies provide a flat allowance per mile, plus allowances for charges such as tolls and parking. This system minimizes bookkeeping but can result in overpayment or underpayment when compared to actual driving costs.Fixed periodic reimbursement.

Some companies provide a flat dollar reimbursement per day, week or month to cover business use of a personal vehicle. This, too, may result in overpayment or underpayment when compared to actual driving costs.Combined fixed and mileage rate.

Realizing that some automobile costs relate to miles driven (fuel, oil, tires and maintenance) and some to ownership (insurance, taxes, interest and depreciation), some companies provide a periodic fixed rate to cover ownership costs and a per-mile rate to cover business miles reported.

The per-mile rates listed in this brochure represent the AAA average of owning and operating a vehicle for a year. Because employees who use their own vehicles for company business also use their vehicles for personal driving, reimbursement should not amount to 100 percent of the total costs.