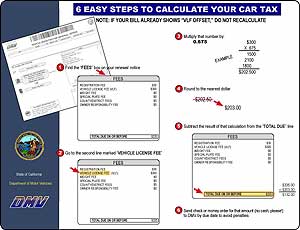

The California DMV has created a simple graphic to help customers who have received renewal notices showing the higher car tax recalculate their fees so they can pay a lower amount immediately and not have to wait for a refund.

The graphic is called "Six Easy Steps to Calculate Your Car Tax." It was designed by DMV to help simplify the recalculation process. It is to be used by customers who had already been billed at the higher amount before Governor Schwarzenegger signed an executive order reducing the car tax. Those renewal notices show expiration dates of October 1, 2003, through January 29, 2004. (Note: billing notices with due dates of January 30, 2004, and later have already been revised to reflect the correct fee. A "Vehicle Fee Offset" and the reduced amount are now reflected on the revised billing notices.) DMV officials have said that if customers have not yet paid the higher fees and don't want to wait for a refund, they can figure out how much they owe using some simple math. All customers have to do is go to the box marked Fees on the renewal notice, go to the line Vehicle License Fee (VLF), multiply that number by 0.675, subtract that number from the Total Due line, and then send in that amount. (Round any amount of 50 cents or higher to the next dollar.) While the Car Tax (the Vehicle License Fee) has been reduced, all other fees are still in force and must be paid on time.

Those who have Internet access can simply log on to the DMV website at www.dmv.ca.gov and use the Car Tax Calculator to automatically refigure their bills. Recalculated bills can only be paid by mail. DMV's web site will not accept Internet payments except for the amount actually billed.

All car tax bills received after Monday of this week (November 24th) will already show the lower amount and do not have to be recalculated.